Auto Insurance near me: Navigating Local Options in the USA

What is Auto Insurance?

Auto insurance is a critical financial tool that protects vehicle owners from the financial burdens of accidents, theft, or other damages to their cars. It is a contract between the policyholder and an insurance provider, where the insurer agrees to cover specified losses in exchange for regular premium payments. In the United States, auto insurance is mandatory in nearly every state, with minimum coverage requirements varying by jurisdiction. Beyond legal compliance, auto insurance offers peace of mind, ensuring that drivers are safeguarded against unexpected repair costs, medical expenses, or liability claims arising from accidents. With the increasing number of vehicles on the road and the diversity of driving conditions across the U.S., choosing the right auto insurance provider is more important than ever.

The growth of insurance agencies across the USA has significantly influenced the auto insurance landscape. As more agencies establish a presence in local communities, drivers have access to a wider range of options, from large national insurers to smaller, regional providers. This expansion has intensified competition, leading to diverse offerings tailored to specific needs, such as affordable rates for high-risk drivers or specialized coverage for commercial vehicles. Companies like BiBerk Auto Insurance, Infinity Auto Insurance, Next Auto Insurance, and Progressive Auto Insurance are among those vying for market share, each with unique strengths and regional footprints. This growth underscores the importance of selecting a provider that aligns with one’s location, driving habits, and financial goals, making proximity to an insurance agency a key consideration for many drivers.

Table of Contents

- What is Auto Insurance?

- Advantages and Disadvantages of Choosing a Local Insurance Agency

- How to Find the Nearest Insurance Agency

- Comparison of Auto Insurance Companies in the USA

- Expansion of Auto Insurance Agencies Across the USA

- Factors to Consider When Choosing an Auto Insurance Provider

- The Role of Technology in Auto Insurance

- Which affects the placement of insurance companies US

- Let’s summarize

- Frequently Asked Questions (FAQs)

Advantages and Disadvantages of Choosing a Local Insurance Agency

Advantages of Local Agencies

Opting for an auto insurance agency near your residence offers several benefits. First, local agencies provide personalized service, often fostering stronger relationships with clients. Agents familiar with your area understand local driving conditions, traffic patterns, and state-specific regulations, enabling them to recommend tailored coverage options. For instance, a local agent in a state prone to natural disasters, like hurricanes in Florida, may suggest comprehensive coverage to protect against weather-related damages. Additionally, proximity facilitates face-to-face interactions, which can be invaluable during claims processing or when discussing complex policy details. Local agencies may also offer faster response times, as they are more accessible for in-person consultations or emergency support. Furthermore, supporting local businesses contributes to the community’s economy, fostering goodwill and potentially unlocking exclusive discounts through partnerships with nearby businesses.

Disadvantages of Local Agencies

However, choosing a local agency has its drawbacks. Smaller agencies may have limited resources compared to national insurers, potentially resulting in fewer coverage options or less competitive pricing. For example, a local provider might not offer specialized policies like rideshare insurance, which larger companies like Progressive provide. Additionally, local agencies may lack the advanced digital tools—such as mobile apps or 24/7 online claims filing—that national insurers often invest in heavily.Another challenge is the potential for higher premiums if the agency operates in a high-risk area with elevated accident rates or theft incidents. Finally, local agencies may represent only a handful of insurers, limiting your ability to compare quotes from multiple providers, which could lead to missed opportunities for savings.

How to Find the Nearest Insurance Agency

Online Tools and Resources

Finding an auto insurance agency near your location has become easier with the advent of digital tools. Websites like Progressive’s agent locator (progressiveagent.com) allow you to enter your ZIP code to find independent agents in your area. Similarly, platforms like Yelp provide reviews and contact details for local insurance agencies, helping you gauge customer satisfaction. Online quote comparison tools, such as those offered by Progressive or Geico, let you explore rates from multiple providers while filtering by proximity.

Local Directories and Community Resources

Traditional methods, such as local business directories or community bulletin boards, remain effective for discovering nearby agencies. Many cities publish directories listing licensed insurance agents, often available at libraries or chamber of commerce offices. Additionally, asking for recommendations from neighbors, friends, or local business owners can lead to trusted agencies with a strong community reputation.

Working with Independent Agents

Independent insurance agents are valuable resources, as they work with multiple insurers, including companies like BiBerk, Infinity, Next, and Progressive. These agents can provide quotes from various providers, saving you time and effort. To find an independent agent, check professional associations like the Independent Insurance Agents & Brokers of America (IIABA) or use online platforms that connect you with agents in your area.

Comparison of Auto Insurance Companies in the USA

BiBerk Auto Insurance

BiBerk, part of the Berkshire Hathaway Group, specializes in commercial auto insurance but also serves small businesses and individual drivers. Known for its online model, BiBerk offers quick quotes and policy management, reducing costs by up to 20% compared to competitors. Its A++ financial strength rating ensures reliability, and customer reviews highlight high satisfaction, with a 4.19/5 rating on TrustPilot. However, BiBerk’s coverage for hired or non-owned vehicles is limited, requiring additional policies for such needs.

Address 1314 Douglas Street , Omaha, Nebraska 68102, US

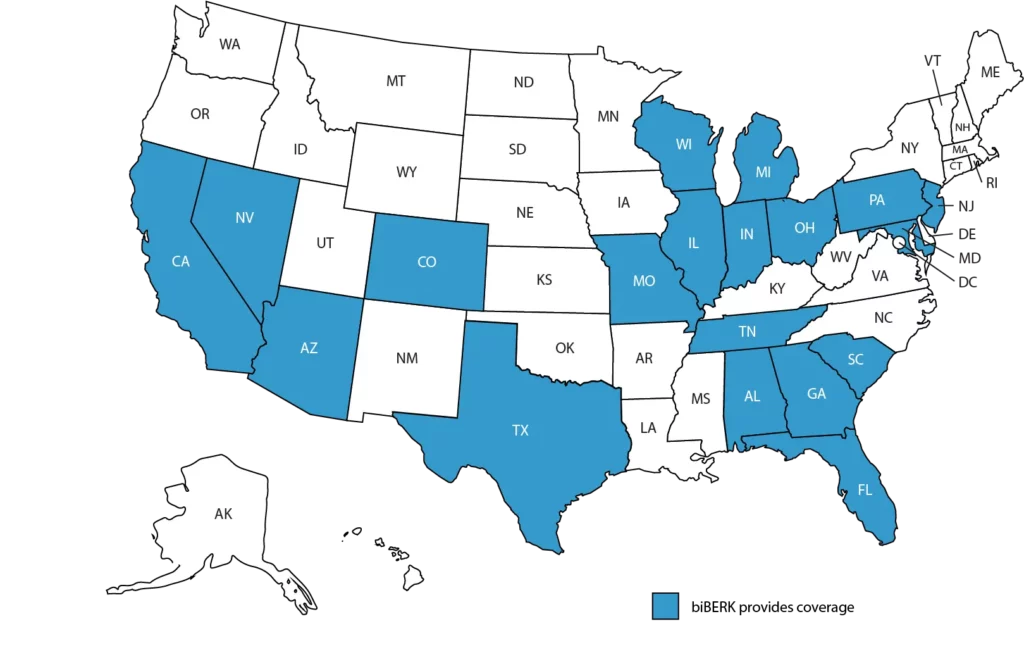

biBERK provides commercial auto coverage for the blue states in the map below.

Infinity Auto Insurance

Infinity Auto Insurance focuses on non-standard drivers, such as those with poor credit or driving violations. It operates primarily in states like California, Texas, and Florida, offering competitive rates for high-risk profiles. Infinity’s strength lies in its flexibility, providing policies tailored to unique needs. However, its smaller market presence limits its reach, and customer reviews on platforms like Yelp suggest inconsistent service quality in some regions.

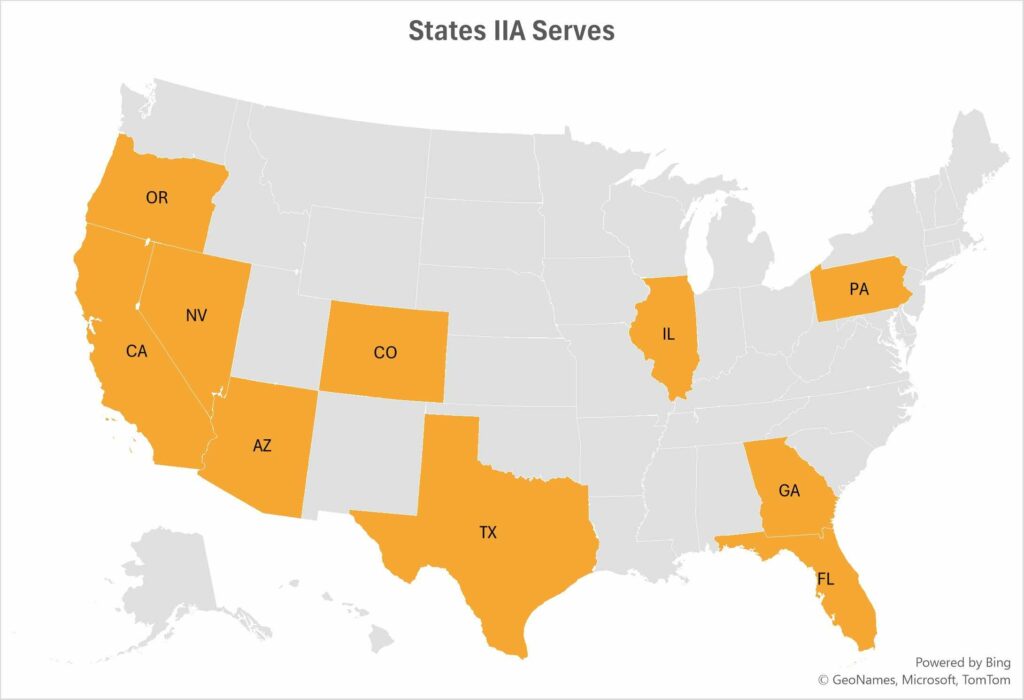

Infinity Insurance Agency, Inc. proudly operates in many states across the country. These states include Arizona, California, Colorado, Florida, Georgia, Illinois, Pennsylvania, Texas, Nevada, and Oregon.

Infinity Insurance Headquarters and Office Locations

| Country | City | Address |

| United States | Chicago | 200 East Randolph Street, Suite 3300 |

| United States | Birmingham | 2201 4th Ave N |

Next Auto Insurance

Next Auto Insurance is a newer player, emphasizing digital-first solutions and affordable rates for small businesses and personal vehicles. Operating in select states, Next leverages technology to streamline quoting and claims processes. Its limited geographic coverage is a drawback, as it may not be available in many rural areas. Customer feedback is sparse, but early reviews indicate satisfaction with its user-friendly platform.

Next Insurance Headquarters and Office Locations

| Country | City | Address |

| United States | Palo Alto | Google Building 975, 975 California Ave |

| United States | Austin | 10801 N Mopac Expy 350 2 |

| United States | Boston | Boston |

| United States | Rochester | Rochester |

Progressive Auto Insurance

Progressive, the second-largest auto insurer in the U.S. with a 16.7% market share, is renowned for its extensive coverage options and discounts, such as Snapshot, a usage-based program rewarding safe driving. Available in all 50 states, Progressive offers robust online tools, including the Name Your Price Tool, and competitive rates for drivers with DUIs. However, customer satisfaction scores are average, with J.D. Power rating its claims process as poor in some regions.

Progressive Corporation Headquarters and Office Locations

| Country | City | Address |

| United States | Mayfield | 6300 Wilson Mills Rd |

| United States | Austin | 7301 Metro Center Dr |

| United States | Carmel | 111 Congressional Blvd |

| United States | Colorado Springs | 12710 Voyager Pkwy |

| United States | Highland Heights | 624 Alpha Dr |

| United States | Indianapolis | 9339 Priority Way W Dr Ste 200 |

| United States | Madison | 301 S Bedford St #1 |

| United States | Mayfield | 300 N Commons Blvd |

| United States | Mayfield | 6671 Beta Dr |

| United States | Mayfield Heights | 5920 Landerbrook Dr |

Expansion of Automobile Insurance Agencies Across the USA

Comparison Table of Agency Expansion

| Company | States Covered | Market Share (2024) | Direct Premiums Written (2024) | Key Regions |

| BiBerk Auto Insurance | 50 | 3.67% | Not publicly disclosed | Nationwide (commercial focus) |

| Infinity Auto Insurance | ~10 | <1% | Not publicly disclosed | CA, TX, FL, AZ |

| Next Auto Insurance | ~15 | <1% | Not publicly disclosed | Urban areas, select states |

| Progressive Auto Insurance | 50 | 16.7% | $57.9 billion | Nationwide, largest in 21 states |

Trends in Agency Growth

The U.S. auto insurance market has seen significant growth, with direct premiums written reaching $383 billion in 2024, a 13% increase from the previous year. Large insurers like Progressive dominate, with a 20.3% rise in premiums, driven by their nationwide presence and robust marketing. BiBerk, while smaller, benefits from its Berkshire Hathaway backing, expanding its commercial auto offerings across all 50 states. Infinity and Next, however, focus on niche markets, with Infinity targeting high-risk drivers in key states and Next growing in urban centers. Smaller agencies often carve out regional niches to compete with giants, offering personalized service but struggling to match the scale of national providers.

Factors to Consider When Choosing an Auto Insurance Provider

Coverage Options

When selecting an insurer, evaluate the range of coverage options available. Progressive offers add-ons like accident forgiveness and gap insurance, while BiBerk provides standard commercial coverages like bodily injury and property damage. Infinity excels in non-standard policies, and Next focuses on streamlined options for small businesses. Ensure the provider offers coverage suited to your needs, such as comprehensive for weather-prone areas or liability for high-risk drivers.

Customer Service and Claims Handling

Customer service quality varies significantly. Progressive’s online tools are top-tier, but its claims satisfaction scores lag. BiBerk’s high customer review ratings suggest reliable service, while Infinity’s reviews are mixed, particularly in rural areas. Next’s digital-first approach appeals to tech-savvy customers but may lack the personal touch of local agencies. Check J.D. Power ratings and customer reviews on platforms like Yelp for insights.

Cost and Discounts

Cost is a major factor, with Progressive offering discounts like multi-policy and Snapshot, while BiBerk’s online model reduces premiums by up to 20%. Infinity provides affordable rates for high-risk drivers, and Next targets budget-conscious consumers. Compare quotes from multiple providers to find the best deal, and inquire about discounts for safe driving, bundling, or automatic payments.

The Role of Technology in Automobile Insurance

Online Quotes and Policy Management

Technology has transformed the auto insurance industry, enabling providers like Progressive and BiBerk to offer instant online quotes and policy management. These tools allow customers to compare rates, customize coverage, and file claims without speaking to an agent. BiBerk’s online platform, for example, simplifies commercial insurance purchases, while Progressive’s mobile app is highly rated for user experience.

Usage-Based Insurance Programs

Usage-based insurance (UBI) programs, like Progressive’s Snapshot, monitor driving habits to offer personalized rates. Safe drivers can save significantly, with discounts based on mileage, braking, and acceleration patterns. Next also explores UBI, appealing to tech-savvy consumers. However, privacy concerns may deter some drivers from enrolling in such programs.

Which affects the placement of insurance companies US

Factors influencing insurance company placement in the US include a mix of economic conditions (inflation, interest rates, tariffs), regulatory complexity, climate change and catastrophe exposure, evolving customer expectations and demand for digital services, cybersecurity risks, technological advancements (insurtech, AI), supply chain issues impacting repair costs, and talent attraction/retention. These elements collectively shape the operating environment, affecting investment decisions, product offerings, and strategic positioning of insurance companies.

Economic & Financial Factors

- Interest Rates: Influences profitability because insurers hold significant long-term bond assets.

- Inflation: Increases the cost of goods and services, raising repair and claim costs.

- Tariffs: Higher tariffs increase costs for imported parts and materials, impacting claims severity and profit margins.

- Investment Environment: Factors like inflation, the cost of capital, and asset valuation influence investment strategies and returns for insurers.

Risk & Environmental Factors

- Climate Change: Increasing natural disasters and catastrophe exposure heightens risk, impacting property and casualty lines.

- Cybersecurity: Growing cyber threats pose risks to insurers’ own systems and the data they handle.

- Supply Chain Disruptions: Impacts the availability and cost of materials needed for repairs, especially in property and auto insurance.

Technological & Digital Transformation

- Insurtech: Disruptive technologies and the growth of insurtech companies are reshaping how insurance products are developed and delivered.

- Digitalization: Customers expect faster, more seamless, and mobile-friendly experiences, requiring insurers to invest in digital platforms and self-service options.

Regulatory & Operational Challenges

- Regulatory Complexity: An evolving and complex regulatory environment requires insurers to adapt and maintain compliance, affecting market entry and operations.

- Talent & Workforce: Attracting and retaining skilled talent is a significant challenge, impacting an insurer’s ability to innovate and operate effectively.

Market & Customer Dynamics

- Evolving Customer Expectations: Policyholders demand more personalized, convenient, and transparent experiences, driving insurers to adapt their offerings and service models.

- Market Capacity: “Hardening” market conditions can lead to reduced capacity, affecting the availability of coverage and increasing premiums.

Let’s summarize

Choosing the right car insurance provider involves balancing cost, coverage, and convenience, with proximity playing a key role for many drivers. Local agencies offer personalized service and community ties but may lack the resources of national giants like Progressive. Companies like BiBerk, Infinity, and Next cater to specific niches, from commercial vehicles to high-risk drivers, while Progressive’s nationwide reach and digital tools make it a versatile choice. The growth of insurance agencies across the USA reflects a competitive market, with direct premiums surging to $383 billion in 2024. By leveraging online tools, comparing quotes, and considering local options, drivers can find coverage that meets their needs and budget. Ultimately, the best choice depends on your driving profile, location, and priorities, making it essential to shop around and consult trusted agents.

Frequently Asked Questions (FAQs)

Auto insurance is required to ensure drivers can cover damages or injuries caused in accidents, protecting both themselves and others financially. State laws set minimum coverage levels to promote road safety and accountability.

Compare quotes from multiple providers using online tools like Progressive’s rate comparison tool or consult an independent agent. Look for discounts, such as multi-policy or safe-driver incentives, and check local agencies for competitive rates.

BiBerk, part of Berkshire Hathaway, focuses on commercial auto insurance with an online model that reduces costs by up to 20%. It offers high customer satisfaction but limited coverage for hired or non-owned vehicles.

Yes, Progressive offers competitive rates for drivers with DUIs or other violations and provides discounts through its Snapshot program. However, its claims satisfaction scores are average.

Many local agencies partner with national insurers like Progressive, allowing you to purchase through an agent while managing your policy online. Check with the agency for digital access options.

Epilogue

Understanding car insurance can be a daunting task, but solution4guru (https://www.solution4guru.com) simplifies this process for users with its comprehensive resources. Firstly, the website offers detailed guides that break down complex insurance terms, such as liability, collision, and comprehensive coverage, making it accessible for beginners and seasoned drivers alike. Additionally, it provides in-depth reviews of various insurance providers, highlighting their strengths and weaknesses, which empowers users to make informed decisions. Furthermore, Solution4Guru features comparison tools that allow individuals to evaluate policies based on cost, coverage limits, and additional benefits like roadside assistance or rental car reimbursement.

Moreover, the platform includes expert tips on assessing personal needs—such as driving habits, vehicle type, and budget—ensuring users select a plan tailored to their lifestyle. Lastly, its blog section offers up-to-date advice on navigating insurance regulations and discounts, enhancing user confidence. By integrating these resources, Solution4Guru not only educates users about the essentials of car insurance but also guides them toward choosing the most suitable option, fostering a seamless and informed decision-making process that aligns with their unique requirements.