ROI in Marketing: How to Calculate and Why Use?

Introduction

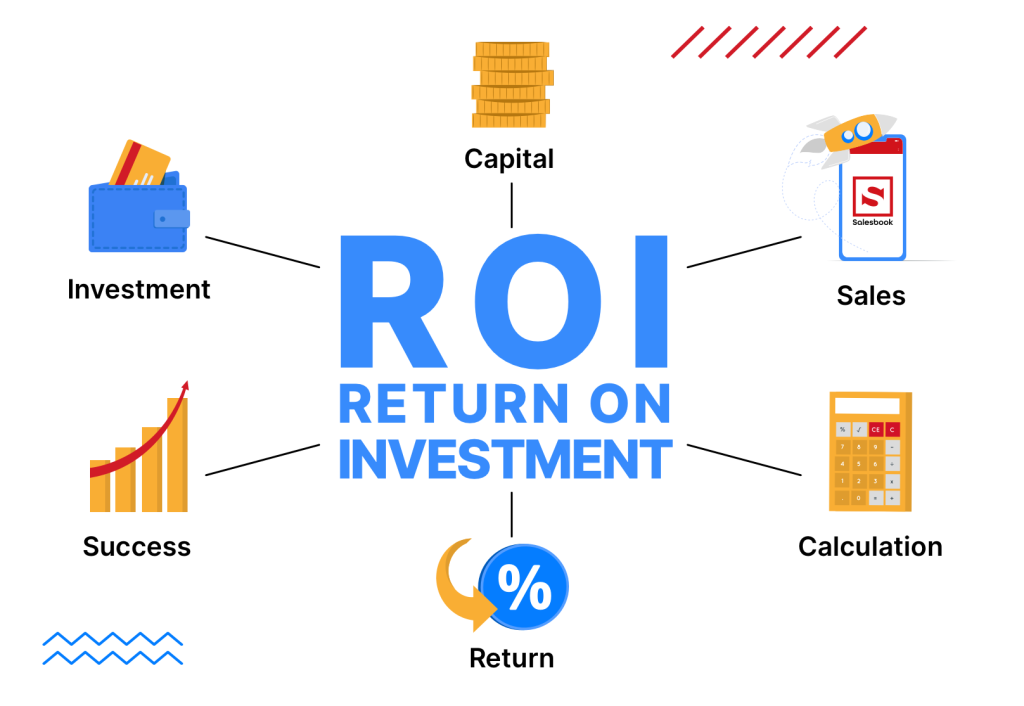

ROI, or Return on Investment, is a fundamental metric in marketing that measures the efficiency and profitability of a particular investment or campaign. At its core, ROI quantifies the return generated from a marketing initiative relative to the resources, time, and money invested in it. It answers the crucial question: “Was the investment worthwhile?”

Return on Investment is expressed as a ratio or percentage comparing the net profit gained from the investment to the initial cost of the investment. A positive ROI indicates that the investment has generated more profit than its cost, signifying a profitable endeavor. Conversely, a negative ROI suggests that the investment did not yield sufficient returns to justify its price, signaling potential inefficiencies or losses.

Understanding Return on Investment is indispensable for marketers as it enables them to evaluate the effectiveness of their strategies, optimize resource allocation, and make informed decisions to drive business growth. Moreover, ROI is a universal benchmark for assessing marketing performance and facilitating comparisons across different campaigns, channels, or initiatives. However, calculating ROI accurately can be complex, requiring careful consideration of various factors such as revenue generated, expenses incurred, and the timeframe over which returns are measured. Despite its challenges, mastering ROI analysis empowers marketers to allocate resources strategically, maximize profitability, and ultimately achieve their organizational goals.

How is ROI different from ROMI and ROAS?

ROI, ROMI (Return on Marketing Investment), and ROAS (Return on Advertising Spend) are all critical metrics in marketing, but they differ in their focus and scope. As mentioned earlier, ROI is a comprehensive metric that assesses the overall return generated from a particular investment, considering both marketing and non-marketing factors. It encompasses all costs and returns associated with a campaign or initiative, providing a holistic view of its profitability.

In contrast, ROMI explicitly evaluates the effectiveness of marketing investments by comparing the revenue generated from marketing activities to the cost of those activities. It focuses solely on marketing expenditures and their impact on revenue, offering insights into the performance of marketing strategies and campaigns.

ROAS, on the other hand, zooms in on advertising spend and its correlation with revenue generation. It measures the revenue generated from advertising efforts relative to the amount spent on those advertisements. Unlike ROI and ROMI, which consider all costs associated with marketing, ROAS isolates the impact of advertising spending on revenue, making it particularly useful for assessing the efficiency of advertising campaigns.

While ROI provides a broader perspective encompassing all investments, ROMI and ROAS offer more specialized insights into the effectiveness of marketing and advertising efforts, respectively. Marketers often utilize a combination of these metrics to gain a comprehensive understanding of their performance and optimize resource allocation for maximum impact and profitability.

Why should a marketer calculate ROI?

Marketers should calculate ROI as it serves as a crucial tool for measuring the effectiveness and efficiency of their marketing efforts. Firstly, ROI provides tangible evidence of the impact of marketing activities on the bottom line, enabling marketers to demonstrate the value they bring to the organization. By quantifying the return from investments relative to their costs, ROI helps justify marketing budgets and secure resources for future initiatives. Moreover, ROI analysis facilitates informed decision-making by identifying which strategies, campaigns, or channels deliver the highest returns. It allows marketers to allocate resources strategically, focusing on activities yielding excellent profitability.

Additionally, calculating ROI enables marketers to optimize campaign performance by identifying areas for improvement and reallocating resources accordingly. Marketers can refine their strategies, enhance targeting, and maximize revenue generation by understanding which tactics generate the highest ROI. Furthermore, ROI is a benchmark for assessing marketing performance over time, enabling marketers to track progress, set realistic goals, and evaluate success. By regularly calculating ROI, marketers can drive continuous improvement, increase profitability, and align marketing efforts with overarching business objectives.

ROI formulas: several ways to calculate the rate of return on investment

Several formulas are available for calculating Return on Investment (ROI), each offering a slightly different perspective on the profitability of an investment.

Basic ROI Formula:

Formula: ROI = (Net Profit / Cost of Investment) x 100%

Explanation: This formula calculates Return on Investment by subtracting the initial cost of investment from the final value of the asset to determine the net profit. Then, it divides the net profit by the initial cost of the investment and expresses the result as a percentage. For example, if an investment costs $10,000 and yields a net profit of $15,000, the ROI would be calculated as follows: ($15,000 – $10,000) / $10,000 * 100% = 50%. This indicates that the return is 50% of the initial investment.

This formula is straightforward and widely used across various industries.

Net ROI Formula:

Formula: Net ROI = (Total Revenue – Total Costs) / Total Costs

Explanation: The Net ROI formula provides a more comprehensive view of an investment’s profitability by considering all associated costs. It subtracts all costs from the total revenue generated, including initial investment, operating expenses, and other related costs. Then, it divides the resulting net profit by the total costs. For example, if an investment generates $50,000 in revenue and costs $30,000 in total expenses, the Net ROI would be calculated as follows: ($50,000 – $30,000) / $30,000 = 0.6667, or 66.67%. This indicates that for every dollar invested, there is a return of $0.67.

This formula provides a more comprehensive view of the profitability of an investment by accounting for all expenses incurred throughout the investment’s lifecycle.

Return on Marketing Investment (ROMI) Formula:

Formula: ROMI = (Revenue Generated from Marketing – Marketing Cost) / Marketing Cost

Explanation: ROMI explicitly evaluates the effectiveness of marketing investments by comparing the revenue generated from marketing activities to the cost of those activities. It focuses solely on marketing expenditures and their impact on revenue. For instance, if a marketing campaign generates $100,000 in revenue and costs $20,000, the ROMI would be calculated as follows: ($100,000 – $20,000) / $20,000 = 4. This indicates that every dollar spent on marketing has a return of $4.

ROMI focuses specifically on marketing expenditures and their impact on revenue, offering insights into the effectiveness of marketing strategies and campaigns.

Return on Advertising Spend (ROAS) Formula:

Formula: ROAS = Revenue Generated from Advertising / Advertising Cost

Explanation: ROAS isolates the impact of advertising spend on revenue by comparing the revenue generated from advertising efforts to the amount spent on those advertisements. It focuses specifically on advertising expenses and their effectiveness in generating revenue. For example, if an advertising campaign generates $50,000 in revenue and costs $10,000, the ROAS would be calculated as follows: $50,000 / $10,000 = 5. This indicates that every dollar spent on advertising has a return of $5.

This formula isolates the impact of advertising spending on revenue by comparing the revenue generated from advertising efforts to the amount spent on those advertisements.

Choosing the most appropriate formula depends on the investment’s specific goals, context, and resources.

Problems with calculating ROI

Calculating Return on Investment (ROI) is undoubtedly a valuable tool for businesses, but it’s not without challenges.

One of the primary issues is determining the appropriate metrics to include in the calculation. Depending on the context, factors such as revenue generated, costs incurred, and the timeframe over which returns are measured can vary significantly, leading to discrepancies in ROI figures.

Moreover, accurately attributing revenue to specific marketing activities or investments can be complex, especially in multichannel or multi-touchpoint campaigns where customer interactions are not linear. This lack of clear attribution can result in inaccurate ROI calculations and misinformed decision-making.

Additionally, ROI calculations often fail to account for intangible benefits such as brand awareness, customer loyalty, or long-term value, which are challenging to quantify but essential for understanding the full impact of marketing initiatives. Furthermore, ROI calculations may overlook opportunity costs, alternative uses of resources, or external factors such as market conditions or competitive actions, which can influence investment outcomes.

Finally, ROI calculations may not provide a complete picture of the risks associated with an investment, as they typically focus on returns relative to costs without considering potential downside scenarios. Despite these challenges, understanding the limitations of ROI calculations and incorporating them into a broader performance measurement framework can help businesses make more informed decisions and optimize their investment strategies effectively.

What should the ROI be, and what should be done with this indicator?

Determining what constitutes a desirable ROI depends on various factors, including industry norms, business goals, and the specific context of the investment.

A positive ROI indicates that an investment has generated more profit than its cost, signaling a profitable endeavor. However, the ideal ROI will vary depending on the investment’s objectives and the organization’s risk tolerance. For instance, high-risk ventures may require higher returns to justify the associated risks, while lower-risk investments may have more modest Return on Investment expectations. Additionally, the ROI target may differ across different stages of a business lifecycle or for other investments. For example, investments in innovation or market expansion may have more extended payback periods and lower initial ROI expectations than investments in established products or markets.

Once the ROI target has been established, businesses can use this indicator to evaluate the performance of their investments and make informed decisions about resource allocation, investment prioritization, and strategic planning. A positive ROI suggests that an investment generates value for the organization and may warrant further investment or expansion. Conversely, a negative ROI may indicate inefficiencies or losses, prompting businesses to reassess their strategies, reallocate resources, or discontinue underperforming initiatives.

Additionally, tracking ROI over time enables businesses to identify trends, evaluate the effectiveness of different strategies, and optimize performance continuously. Ultimately, while Return on Investment is a valuable metric for assessing the profitability of investments, it should be considered alongside other factors such as risk, opportunity costs, and strategic alignment to make well-rounded investment decisions and drive sustainable business growth.

What to do if the ROI is low or negative?

When confronted with a low or negative ROI, businesses must undertake a strategic and analytical approach to address the underlying issues.

- Firstly, conducting a thorough analysis is essential to identify the root causes of the low or negative ROI. This may involve reviewing the marketing strategies, channels, targeting methods, and campaign execution to pinpoint areas of inefficiency or underperformance.

- Once the factors contributing to the low ROI are identified, businesses can develop and implement corrective actions to improve Return on Investment. This could involve reallocating resources to more effective channels or tactics, refining targeting strategies to reach a more relevant audience, optimizing campaign messaging or creative assets, or renegotiating contracts with vendors to reduce costs.

- Additionally, businesses may need to consider broader strategic changes, such as reevaluating product offerings, adjusting pricing strategies, or reassessing market positioning to address fundamental ROI issues. Moreover, ongoing monitoring and measurement of ROI are crucial to track the effectiveness of implemented solutions and make further adjustments as needed.

Businesses can optimize their marketing efforts, improve profitability, and drive long-term success by taking a proactive and data-driven approach to address low or negative Return on Investment.

Сonclusion

In conclusion, ROI in marketing serves as a fundamental metric for businesses, providing valuable insights into the efficiency and effectiveness of their marketing investments. By calculating Return on Investment, companies can quantify the returns generated from marketing activities relative to their costs, enabling informed decision-making, resource optimization, and strategic planning.

Despite the challenges associated with calculating ROI, such as attribution complexities and intangible benefits, businesses can leverage this indicator to evaluate performance, prioritize investments, and drive profitability. Moreover, understanding what constitutes a desirable ROI and taking proactive measures to address low or negative Return on Investment can help businesses maximize the impact of their marketing efforts and achieve their objectives.

Ultimately, ROI analysis should be integrated into a broader performance measurement framework, incorporating other factors such as risk, opportunity costs, and strategic alignment to make well-rounded investment decisions and foster sustainable business growth in an increasingly competitive landscape.

You might also be interested in 10 Key Benefits of Marketing Automation