Insurance Provider Selection Assistant Review. Features, Benefits and how It helps You Choose Smarter

What is Insurance and Why Does It Matter?

What exactly is insurance? At its core, insurance is a financial arrangement that provides protection against potential risks and losses by transferring the financial burden from an individual or entity to an insurer. In exchange for regular payments called premiums, insurance companies agree to cover specified losses, such as medical expenses, property damage, or liability claims, should an adverse event occur. This mechanism acts as a safety net, offering peace of mind and financial stability in unpredictable circumstances. From car accidents to medical emergencies, insurance mitigates the economic impact of life’s uncertainties, allowing individuals and businesses to recover without devastating financial consequences.

Why is insurance a cornerstone of modern society? By spreading risk across a large pool of policyholders, insurance enables people to plan for the future with confidence, knowing they’re protected against unforeseen events. According to the Insurance Information Institute, the global insurance industry paid out over $1.4 trillion in claims in 2023, underscoring its critical role in supporting economic stability. Whether safeguarding homes, health, or businesses, insurance fosters resilience, making it an essential tool for navigating the complexities of today’s world.

Table of Contents

- What is Insurance and Why Does It Matter?

- What Are the Types of Modern Insurance?

- Why is Insurance Important and Necessary in the Modern World?

- What Are the Advantages and Disadvantages of Insurance?

- How Do You Choose the Right Insurance?

- Insurance Provider Selection Assistant

- Why the Insurance Provider Selection Assistant is essential?

- Key Features of Insurance Provider Selection Assistant

- Best Practices for Using the Insurance Provider Selection Assistant

- FAQs

Quick Summary

| Takeaway | Explanation |

| Definition of Insurance | Insurance is a financial arrangement where individuals or businesses pay premiums to a provider to protect against potential losses or risks. |

| Risk Management | It transfers the financial burden of unexpected events, like accidents or natural disasters, from the insured to the insurer. |

| Types of Insurance | Common types include health, auto, home, life, and business insurance, each tailored to specific needs and risks. |

| Premiums and Coverage | Policyholders pay regular premiums for coverage, with payouts depending on the policy terms and conditions. |

| Importance for Stability | Insurance provides financial security, helping individuals and businesses recover from losses without severe economic impact. |

| Regulatory Oversight | Insurance is regulated to ensure fair practices, with policies varying by region to meet legal and consumer needs. |

What Are the Types of Modern Insurance?

What types of insurance are available today? The insurance industry offers a diverse range of products tailored to protect various aspects of life and business. Here’s a look at the most common types of modern insurance, each addressing specific risks:

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, and prescriptions. It’s vital for managing healthcare costs, especially in countries with high medical expenses.

- Auto Insurance: Protects against financial losses from car accidents, theft, or damage. It includes liability coverage for injuries or property damage and collision coverage for vehicle repairs.

- Homeowners Insurance: Safeguards homes and personal property against risks like fire, theft, or natural disasters. It also covers liability for injuries occurring on the property.

- Renters Insurance: Protects tenants’ belongings and provides liability coverage, similar to homeowners insurance, but excludes the dwelling itself.

- Life Insurance: Provides a payout to beneficiaries upon the policyholder’s death, ensuring financial security. Term life covers a specific period, while whole life includes investment components.

- Disability Insurance: Replaces income if the policyholder becomes unable to work due to illness or injury, covering short-term or long-term disabilities.

- Travel Insurance: Covers trip cancellations, medical emergencies, or lost luggage during travel, offering peace of mind for frequent travelers.

- Business Insurance: Includes general liability, property, and workers’ compensation to protect companies from lawsuits, property damage, or employee injuries.

- Cyber Insurance: Addresses risks from data breaches or cyberattacks, covering costs like legal fees and customer notifications.

- Pet Insurance: Covers veterinary expenses for pets, including surgeries or chronic condition treatments.

Why are there so many options? The variety reflects the diverse risks individuals and businesses face, ensuring tailored protection for specific needs.

Why is Insurance Important and Necessary in the Modern World?

Why is insurance a critical component today? In an era of increasing uncertainty, insurance provides a financial safety net that protects individuals, families, and businesses from devastating losses. Modern life is fraught with risks—natural disasters, health crises, accidents, and cyberattacks can disrupt lives and livelihoods without warning. Insurance mitigates these risks by covering costs that could otherwise lead to financial ruin. For example, a single hospital stay in the U.S. can cost upwards of $10,000 without health insurance, while a car accident could result in tens of thousands in liability claims. Insurance ensures these expenses don’t derail financial stability.

Moreover, insurance supports broader societal benefits. It promotes economic resilience by enabling faster recovery after disasters, as seen when insurers paid over $99 billion for natural catastrophe claims globally in 2022, per Swiss Re. It also encourages responsible behavior, such as safe driving, since insurers often reward low-risk policyholders with lower premiums. Additionally, legal requirements in many regions—like auto insurance mandates—ensure accountability and protect third parties. Without insurance, individuals and businesses would face greater vulnerability, making it an indispensable tool for navigating the complexities of modern life.

What Are the Advantages and Disadvantages of Insurance?

What benefits does insurance offer? Insurance provides numerous advantages that make it a cornerstone of financial planning:

- Financial Protection: Covers unexpected expenses, preventing financial hardship from events like accidents or illnesses.

- Peace of Mind: Reduces stress by ensuring coverage for potential risks, allowing individuals to focus on daily life.

- Risk Management: Spreads financial risk across policyholders, making large losses manageable.

- Legal Compliance: Meets mandatory requirements, such as auto or workers’ compensation insurance, avoiding penalties.

- Economic Stability: Supports recovery after disasters, enabling businesses and individuals to rebuild quickly.

However, what are the drawbacks? Insurance also has limitations that users should consider:

- Cost of Premiums: Regular payments can strain budgets, especially for comprehensive coverage.

- Complex Terms: Policies often include jargon-heavy fine print, leading to misunderstandings about coverage.

- Claim Denials: Insurers may reject claims due to policy exclusions or insufficient documentation, causing frustration.

- Over-Insurance: Paying for unnecessary coverage can waste money if risks are low.

- Fraud Risks: False claims or misrepresentation can lead to higher premiums for all policyholders.

Why weigh these factors? Balancing the benefits against potential drawbacks helps individuals make informed decisions, ensuring they select coverage that aligns with their needs and budget.

How Do You Choose the Right Insurance?

How can you select the best insurance policy? Choosing the right insurance requires careful consideration to ensure adequate protection without overpaying. Here are key steps to guide your decision:

- Assess Your Needs: Identify the risks you face, such as health issues, property value, or travel frequency, to determine necessary coverage types.

- Compare Providers: Research reputable insurers like Allstate, Progressive, or Aetna, comparing their offerings, customer reviews, and financial stability ratings (e.g., AM Best).

- Evaluate Coverage Options: Review policy details, including coverage limits, exclusions, and deductibles. For example, a lower premium may mean higher out-of-pocket costs during claims.

- Check Premium Costs: Ensure premiums fit your budget while providing sufficient coverage. Bundling policies (e.g., home and auto) can reduce costs.

- Understand Policy Terms: Read the fine print to avoid surprises, such as exclusions for pre-existing conditions in health insurance.

- Seek Professional Advice: Consult brokers or independent agents for tailored recommendations, especially for complex needs like business insurance.

- Leverage Technology: Use comparison websites like Policygenius or Insurify to analyze quotes from multiple providers efficiently.

Why is this process crucial? A well-chosen policy balances cost and coverage, protecting you from financial loss while aligning with your lifestyle or business needs. For instance, a young driver might prioritize affordable auto insurance, while a homeowner may focus on comprehensive property coverage.

But most people always have difficulty choosing any type of insurance – and we have a solution – our resource will help you. Let’s take a closer look below.

Insurance Provider Selection Assistant

Are you overwhelmed by the endless maze of insurance options? Introducing the Insurance Provider Selection Assistant by Solution for Guru – the smarter way to find the perfect insurance provider tailored to your needs.

Here is a step-by-step guide to help you make the right choice.

- Resource. Go to the resource where you will need to select the necessary parameters for the perfect result that will satisfy all your requirements.

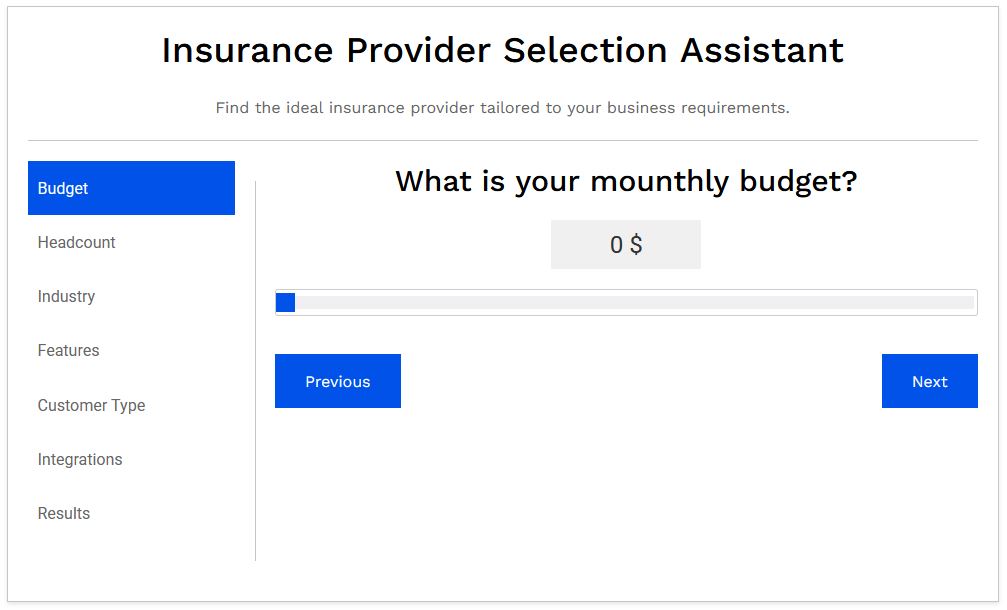

- The question of price. When choosing insurance, price often becomes a key deciding factor. While affordability is important, the cheapest option isn’t always the best. It’s crucial to balance cost with coverage, ensuring that essential protections aren’t sacrificed for lower premiums. Comparing policies helps reveal hidden fees, exclusions, and value-added benefits. The right choice is one that offers fair pricing while delivering the coverage and peace of mind you truly need. Move the slider to the right or left and choose your budget amount accordingly.

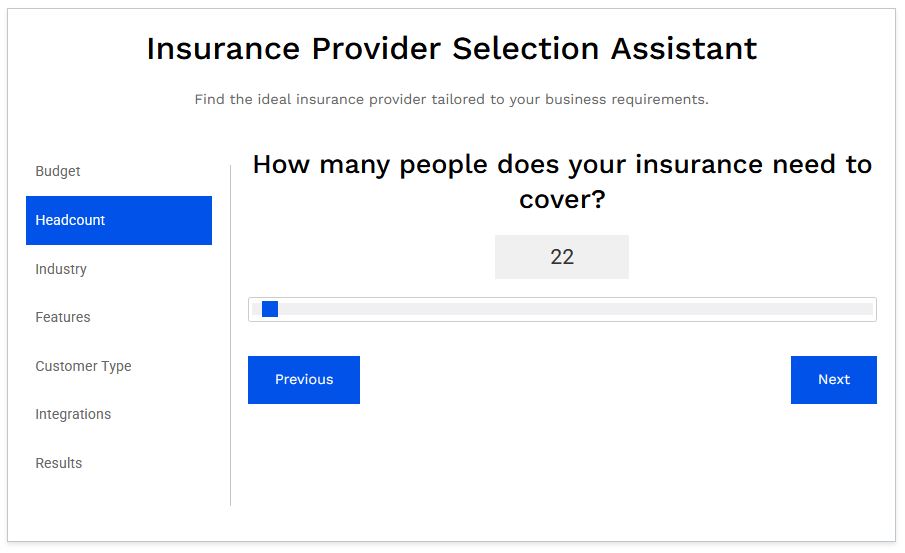

- Number of clients. When choosing an insurance policy, it’s important to decide how many people the coverage will protect. A single policy may be enough for individuals, but families often benefit from group or family coverage that includes spouses and dependents. The number of insured people directly affects the cost, level of protection, and flexibility of the policy. Carefully evaluating household needs ensures everyone receives proper protection without paying for unnecessary coverage. Move the slider to the right or left and choose choose the number of people the insurance will protect.

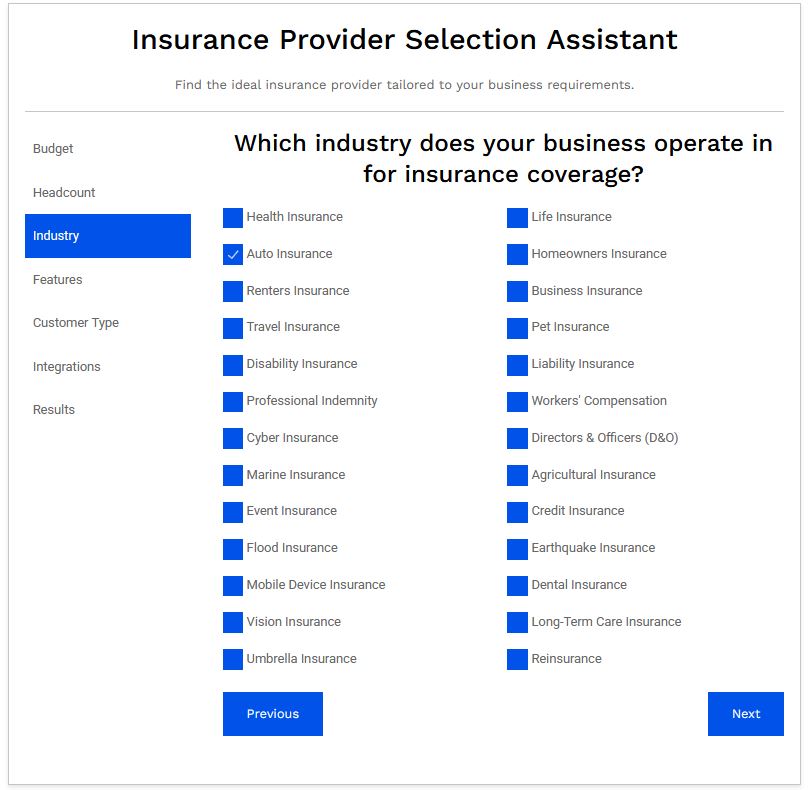

- Choosing the type of insurance. Choosing the right category of insurance—whether auto, health, home, or life—depends on your individual needs and priorities. Auto insurance protects your vehicle and financial liability, while health insurance covers medical costs. Home insurance safeguards property against risks, and life insurance secures your family’s future. Each category offers unique benefits, so the decision should balance personal risks, lifestyle, and budget. Carefully matching coverage to your situation ensures meaningful protection and peace of mind. Simply indicate what insurance you are interested in by selecting the required checkbox.

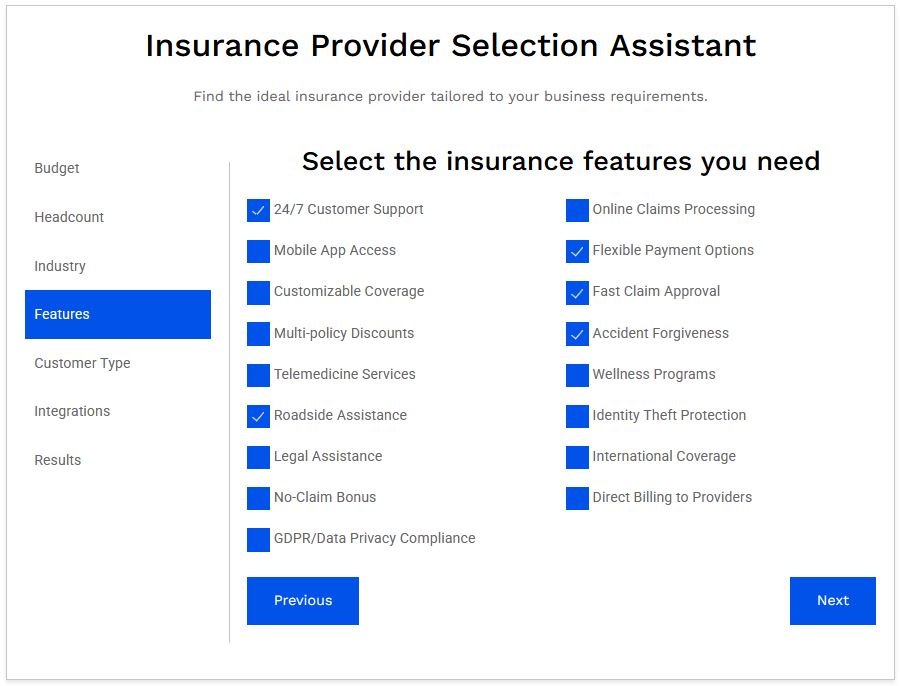

- Insurance features. When selecting an insurance policy, evaluating its features is just as important as comparing prices. Auto insurance may include roadside assistance, while health insurance could offer preventive care or wellness programs. Additional features like accident forgiveness, global coverage, or telemedicine access can greatly enhance value. The right features ensure the policy aligns with your lifestyle, offering not just protection but also convenience, peace of mind, and long-term financial security. Specify what you need.

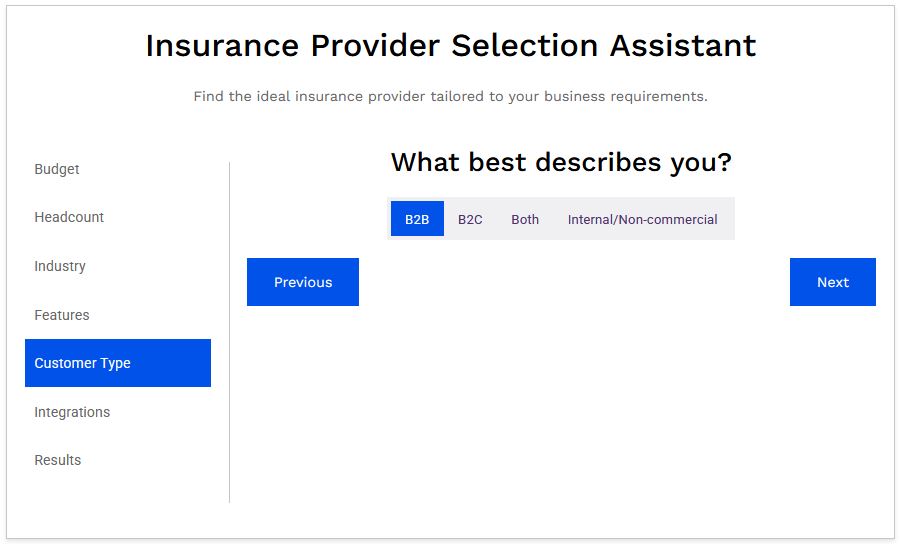

- Customer type. When choosing the customer type of insurance, it’s vital to match the policy with the intended audience. B2B insurance often focuses on liability, employee coverage, and business continuity, while B2C policies address personal needs like health, auto, or home protection. Internal or non-commercial insurance typically supports employees or organizational assets. Understanding the customer type ensures tailored coverage, reduces risks, and maximizes value—making the policy truly relevant to the insured party’s needs. Specify what you need.

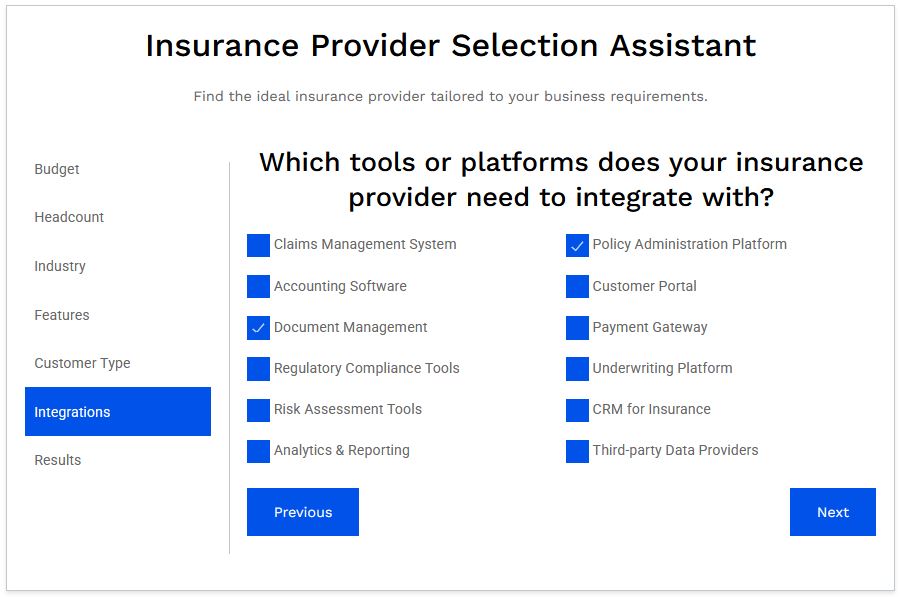

- Integration. When selecting an insurance provider, it’s important to evaluate the platforms their system can integrate with. Smooth integration with accounting software ensures accurate billing and financial tracking, while document management systems streamline policy handling and compliance. A customer portal enhances transparency, offering clients direct access to policies, claims, and updates. The right integrations improve efficiency, reduce manual errors, and deliver a seamless experience for both the provider and the insured—making technology a key factor in the decision process. Choose everything you need!

- Getting results. Enter your email and get the result.

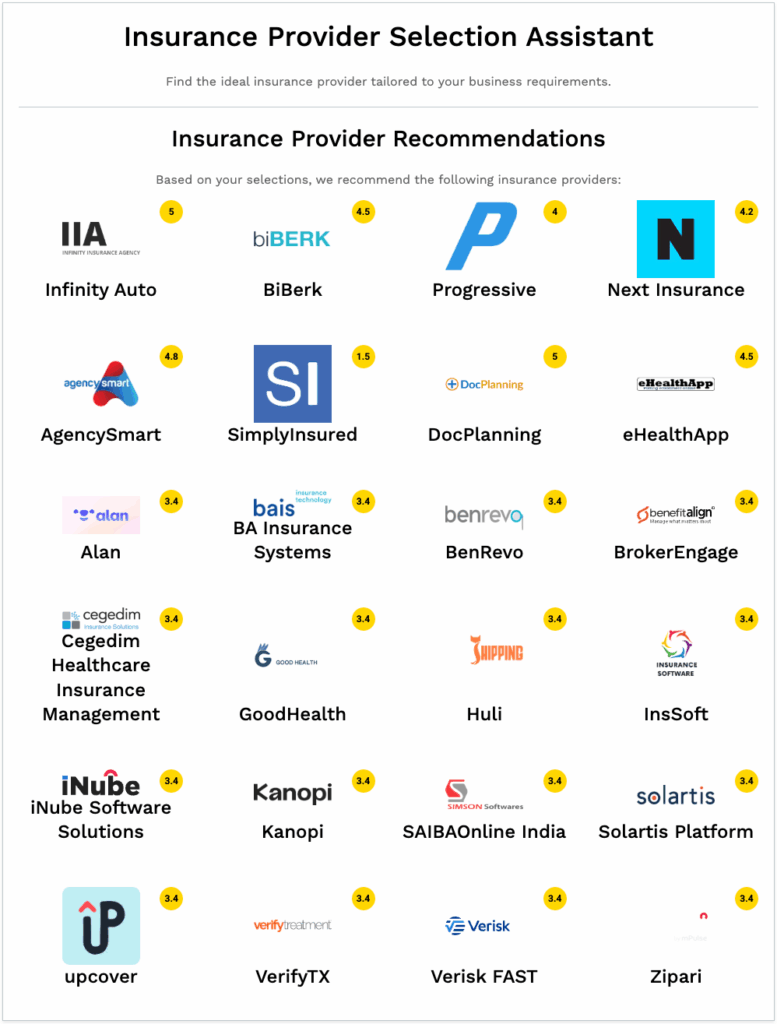

As a result – you will receive a list of companies that meet your requests and requirements:

Top Insurance Platforms

We are working with – Infinity Auto, BiBerk, Next and Progressive. Infinity Auto is known for customizable auto insurance policies with flexible coverage options. BiBerk, a Berkshire Hathaway company, focuses on small business insurance, offering reliable and affordable solutions. Next Insurance specializes in digital-first business insurance, making it easy for small business owners to get coverage online. Progressive is one of the largest and most recognizable insurers in the U.S., offering a wide range of personal and commercial insurance products, including innovative tools like Snapshot for personalized auto rates. Each company caters to different needs, from personal auto coverage to business-focused insurance solutions.

Why the Insurance Provider Selection Assistant is essential?

An online service like the Insurance Provider Selection Assistant is becoming increasingly essential in today’s fast-paced world, where choosing the right insurance can be overwhelming. Insurance comes in countless forms—auto, health, business, life, and more—and each policy varies in coverage, price, and additional features. Navigating this landscape manually often requires hours of research, comparing providers, reading fine print, and evaluating whether a policy meets your unique needs.

This portal simplifies the process by centralizing all relevant information and offering personalized recommendations based on key parameters such as budget, number of insured persons, type of insurance, type of client, integration with third-party systems, and desired features. Users no longer need to sift through dozens of websites or call multiple insurers to get quotes. Instead, the assistant analyzes the options and matches users with the most suitable insurance providers quickly and efficiently.

For businesses, the portal is particularly valuable, as it can evaluate whether insurance policies integrate with tools like accounting software, document management systems, or customer portals, ensuring seamless workflows. For individuals, it helps identify policies that balance cost and coverage while meeting personal requirements.

By providing a streamlined, data-driven, and user-friendly experience, the Insurance Provider Selection Assistant saves time, reduces stress, and empowers users to make informed decisions. It transforms insurance selection from a complex, confusing task into a simple, guided process—ensuring that every person or business can find the coverage they need without unnecessary hassle.

Key Features of Insurance Provider Selection Assistant

- Budget-Based Matching. The portal allows you to choose a price range to suit your budget;

- Personalized for Number of Insured Persons. Whether you need insurance for yourself, your family, or your employees, the system tailors recommendations based on the number of people covered;

- Multiple Insurance Types. From auto and health to business and life insurance, the assistant covers diverse categories, helping you find the right policy type quickly;

- Client Type Differentiation. The service distinguishes between B2B (businesses), B2C (individuals), and internal/non-commercial clients, ensuring relevant and accurate policy recommendations;

- Integration with Third-Party Tools. Especially valuable for businesses, the assistant checks whether insurance providers integrate with accounting software, document management, or customer portals for smoother operations;

- Finding the best options. After the user enters all the necessary filters, the system provides the result – a list of insurance companies that meet his requirements;

- Time-Saving Decision Support. Instead of browsing multiple websites, the assistant consolidates information, analyzes options, and presents tailored choices—saving significant time and effort.

This way, the portal not only streamlines the search but also ensures the insurance you select fits your financial, personal, and operational needs.

Best Practices for Using the Insurance Provider Selection Assistant

- Define Your Budget Clearly. Before starting, set a realistic budget range. This ensures the assistant filters out unsuitable options and focuses on policies you can actually afford.

- Specify the Number of Insured Persons Accurately. Whether it’s just you, your family, or your employees, entering the correct number helps the system recommend the right coverage amount and package type.

- Choose the Correct Client Type (B2B, B2C, Internal). Selecting the right client category ensures that results are tailored—businesses get professional packages with integrations, while individuals receive personal insurance recommendations.

- Explore Multiple Insurance Types. Don’t limit yourself to just one category. Compare auto, health, life, and business options to see if bundling coverage can save you money.

- Check for Third-Party Integrations. For businesses, always review whether an insurer integrates with your accounting, CRM, or document management software—this can save time and reduce admin work.

- Regularly Update Your Preferences. Needs change—like adding new family members, hiring staff, or adjusting budgets. Revisit the platform periodically to keep your coverage aligned with your current situation.

Following these best practices ensures you’re not just picking the cheapest or first option, but truly finding the most efficient, cost-effective, and future-proof insurance solution.

FAQs

It’s an online platform that helps individuals and businesses find the most suitable insurance by comparing providers based on budget, client type, coverage needs, and integrations with third-party tools.

Instead of browsing dozens of websites, the assistant consolidates information, analyzes your input, and instantly suggests the most relevant policies.

Yes. The platform supports both B2B and B2C clients, and even considers business-specific needs like software integrations and employee coverage.

No. The assistant includes multiple categories such as auto, health, business, life, and specialized insurance types.

Absolutely. You can specify the number of insured persons, and the system tailors recommendations for individuals, families, or groups.

The platform highlights important differences—like add-ons, discounts, claims process efficiency, and digital tools—so you can make an informed decision.

Not at all. The assistant is designed with a simple, user-friendly interface so anyone can use it without prior insurance or tech expertise.

Choose the best type of insurance with Solution4Guru

Are you looking for the right type of insurance for a long time? Do you spend a lot of time browsing many resources, comparing different characteristics, reading many reviews and still can’t figure out what is better to choose?

In fact, choosing an insurance policy is an important step in ensuring your financial stability. Taking into account key criteria and recommendations will help you make the right decision. Remember that your well-being and peace of mind are the best investments in the future. To make your task easier and save a lot of time, visit Solution4Guru! Here you will find many answers to your questions – recommendations, descriptions, tips, comparisons of different systems, etc.

Our Insurance Provider Selection Assistant transforms the often confusing and time-consuming process of choosing insurance into a simple, guided experience. By focusing on key parameters like budget, client type, coverage needs, integrations, and features, the platform delivers tailored recommendations that truly fit individual or business requirements. Instead of endless research and guesswork, users gain clarity, confidence, and efficiency in decision-making. Ultimately, this smart tool saves time, reduces stress, and ensures everyone—from individuals to organizations—finds the insurance coverage that best supports their goals.